9 eCommerce Payment Processing Companies For Secure Transactions

The sheer volume and diversity of eCommerce transactions demand a seamless and secure payment processing system. It’s all about enabling the online shopper to use their credit cards efficiently to purchase products from anywhere and anytime.

But with many options available, selecting the top-notch payment processors for your eCommerce business can be daunting.

Among many, specific established names have emerged as leaders, given their track record in secure transactions and easy integrations. Businesses swear by four such processors: Stripe, Amazon Pay, Square, and Helcim.

Choosing a suitable eCommerce payment processor is not just about transaction fees; it’s also about the ease it creates for your customers and thus directly impacts your business growth.

Every eCommerce business has its unique requirements and challenges. That’s why it’s crucial to understand the features and benefits of these top payment processors before deciding on the right one for your specific needs.

How Payment Processing Works

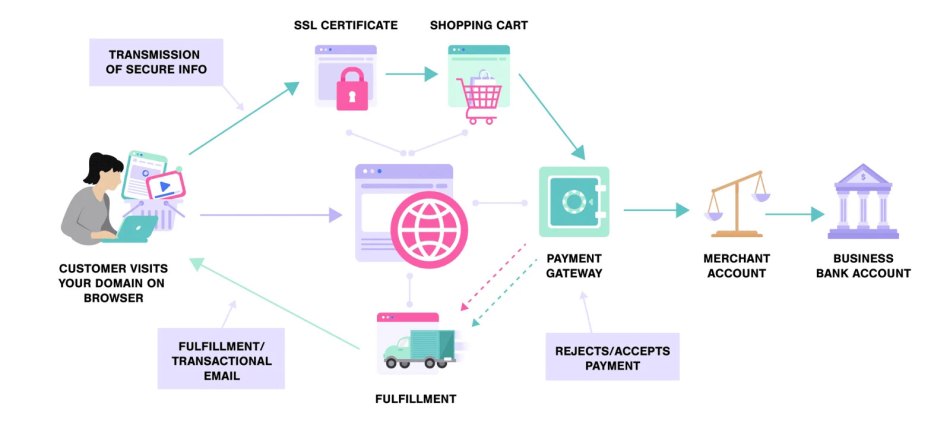

Ever wondered about the path money travels from a customer’s credit card to your business account when a sale is made in your online store?

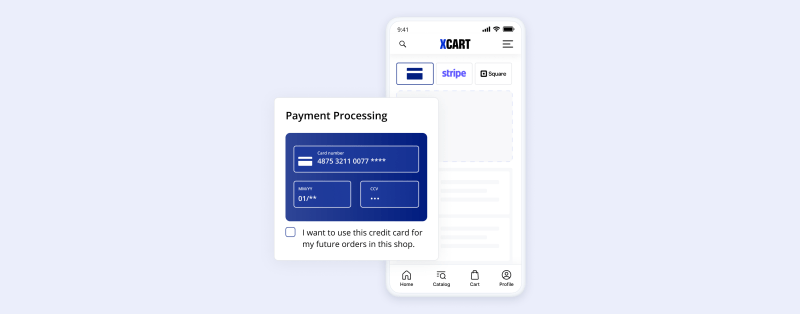

This is all made possible by credit card processing companies. They facilitate the smooth transfer of funds between banks and businesses, all via sophisticated mechanisms known as payment gateways.

When a customer makes a purchase on your eCommerce site and enters their credit card details, the payment gateway starts working. This augments your online platform with the payment processor, confirming the transaction and conducting security checks. After getting approval from the credit card company, the payment processor shifts funds from the customer’s bank to a special holding account known as a merchant account. These funds are transferred to your business’s account after a short settling period.

This payment processor service isn’t free. They charge a processing fee that varies per processor but usually consists of a small percentage of the transaction amount and a fixed fee per transaction. This covers their operational expenses and their risks in managing fund flows. The role of eCommerce payment processing in providing a secure and efficient online sales experience can’t be underestimated, making it a crucial element for every eCommerce store owner.

Key Features to Look for in a Payment Processing Company

You have a wide array of options to choose from when it comes to eCommerce payment options, but not all are created equally. As you evaluate your options, there are several key features you should be on the lookout for.

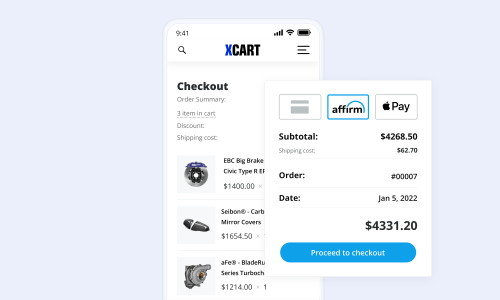

Firstly, consider the types of payment methods the processor accepts. Does it take credit and debit cards, digital wallets like Google Pay or Apple Pay, and other eCommerce-friendly payment methods? Does it have an integrated POS system for in-person sales? The more diverse the payment options that your processor can handle, the better.

You’ll also want to pay attention to transaction speed. How long does it take for payments to go from pending to being placed in your account? You’ll want a processor to do this efficiently, as slow transaction speeds can lead to cash flow problems.

In addition to its role as a strategic business asset, a robust payment processing system should offer comprehensive reporting features to provide valuable insights into sales performance, customer behavior, and transaction details.

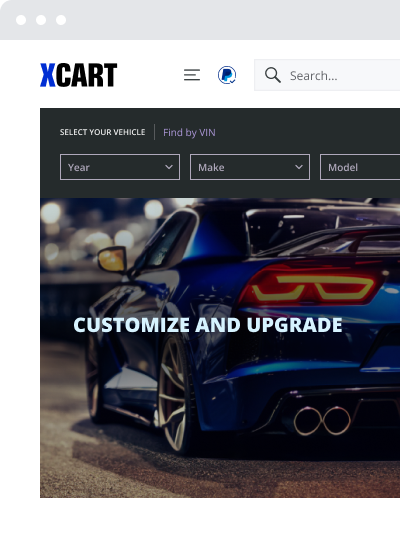

Some eCommerce payment processing companies offer integrated inventory management features, which can help you keep track of your stock levels in real-time and streamline your business operations.

In addition to these features, several payment processing companies also provide a range of flexible payment forms tailored to your specific business requirements. Options such as ACH (Automated Clearing House) can facilitate smoother transactions, increasing efficiency and enhancing the customer shopping experience, which is especially important with B2B eCommerce.

Finally, consider the processor’s ease of use for you and your customers. Is it easy to integrate the processor into your eCommerce platform? And is it straightforward and convenient for your customers to use at checkout?

The experience for both you and your customer should be hassle-free and intuitive.

While finding the right eCommerce payment processing company may seem daunting, focusing on these key features should help you narrow your search effectively.

Top eCommerce Payment Processing Companies

Selecting a fitting payment processor for your online store is a careful process. It’s about finding a service that augments your business model and provides an unbeatable customer experience with a simple order process.

Your unique business size, type, and sector influence your options. Start reviewing transaction fees, processing times, and the provision for international payments. Security measures and customer support responsiveness are vital when dealing with sensitive customer payments.

Thorough research before selecting your payment processing partner can save significant time money, and ensure a smooth purchasing experience for your customers.

Stripe

You might want to keep Stripe on your radar if you’re operating a small-to-medium-sized business. Notably known for its transparent, pay-as-you-go pricing model, you can find simplicity in Stripe’s 2.9% + 30¢ per successful charge.

But it’s not only about affordable rates. Stripe is praised for its robust feature range offering—real-time analytics, multi-party transactions, subscription models, and more. All this aims to fulfill your payment-processing needs and optimize your entire business operation. With Stripe for X-Cart, payment processing is uncomplicated yet powerful.

Braintree

Braintree, a PayPal service, is a comprehensive payment platform providing various features. It offers methods including credit and debit cards, PayPal, and Venmo. Unique offerings like the one-touch payment service streamline the buyer’s journey.

Braintree’s SDKs and APIs enable bespoke payment experiences prioritizing your brand’s unique needs. It provides 24/7 customer support, offering assistance round-the-clock. The company charges a standard processing fee of 2.59% + $0.49 per transaction for its services. Try the Braintree add-on for X-Cart.

Square

You might find Square a remarkable solution within the eCommerce payment processing scene. A key draw is its range of features, from customizable checkout experiences to real-time analytics and POS to accept sales in person. Uniquely, Square charges a flat rate for online transactions, typically 2.9% + 30¢ per transaction.

As for customer support, queries and issues are addressed promptly with their highly accessible team, available via phone, email, or chat A.I. This blend of functionality, transparency, and support may make Square the right fit for your business needs. Check out the Square add-on for X-Cart.

Amazon Pay

Amazon Pay might be your solution if you’re looking to simplify your checkout process. This eCommerce payment processor lets your customers use the information already stored in their Amazon accounts to make purchases, making the checkout seamless and hassle-free.

Amazon Pay’s unique feature is its ‘Voice commerce,’ which is enabled by integration with Amazon Alexa and allows hands-free payments. Regarding processing fees, Amazon Pay operates on a sliding scale, with fees ranging from 2.9% + $0.29 per transaction for domestic U.S. transactions up to 3.9% + $0.30¢ for cross-border transactions. The best part? Amazon Pay works with X-Cart.

PayPal

PayPal, widely recognized in the realm of eCommerce, offers a plethora of unique features. Their OneTouch checkout simplifies purchases, bolstering conversion rates, while “PayPal Credit” allows customers to pay over time. Interlinking with other e-wallets like Venmo and Xoom furthers PayPal’s scalability.

Regarding processing fees, they’re quite competitive. For sales within the U.S., you’re looking at 1.9% + $0.49 per transaction. Lower rates may be available depending on your sales volume, making PayPal a versatile payment processor worth considering. PayPal is a must-have option for X-Cart.

Go Cardless

GoCardless is an excellent choice for businesses that operate on a subscription model. It’s designed to streamline recurring payments, making it easy for you to get paid consistently. In addition to the convenience of automated collection, GoCardless provides flexibility regarding payment schedules.

You can set up payments to go out weekly, monthly, quarterly, or whatever schedule best fits your business model. And, with processing fees at just 0.5% + $0.05 per transaction, capped at $5, you’ll simplify your income stream and keep expenses low.

Payline Data

Payline Data stands out for its interchange-plus pricing model, presenting a transparent fee structure. They aim to offer businesses material savings over time. Processing fees start at 0.75% + $0.20 for online transactions and 0.4% + $0.20 for in-store transactions.

The lower processing fees are made possible because Payline data also has monthly fees. Unique features include integrated payment options and next-day funding—ensuring they’re a favored choice for small businesses looking to simplify online transactions while keeping costs down.

SecurePay

SecurePay, based in Australia, offers a suite of payment solutions tailored for businesses of all sizes. Their standout feature is the multi-layered security measures, including fraud protection tools and secure customer data storage.

Besides the standard card payment options, they offer Online Payments, an all-in-one solution incorporating a payment gateway and a merchant account. According to SecurePay’s pricing page, the transaction fee is just 1.75% + $0.30 AUD per transaction, making it an affordable choice for businesses, especially those prioritizing security. Try our add-on.

Helcim

For online businesses, Helcim is a prime choice for an eCommerce payment processor. Helcim is transparent, offering clear customer pricing- 2.49% + $0.25 per transaction for online sales. Helcim also includes free access to its all-in-one merchant platform with accounts, eliminating the need for costly add-ons.

This platform supports invoicing, recurring payments, customer management, and real-time analytics, making it a comprehensive solution for a growing eCommerce business.

Understanding Pricing and Fee Structures

Let’s get down to the nitty-gritty of pricing and fees. When it comes to eCommerce payment processors, understanding the cost implications is vital. There is, of course, a multitude of charges to consider. You might encounter setup fees, monthly fees, payment processing fees, and sometimes even cancellation fees.

Let’s begin, shall we?

- Setup fees are one-time charges that some companies impose when you first onboard their services. Don’t be easily disheartened when you experience this – not every company has these fees.

- Monthly fees are recurring charges you pay for the ongoing use of the platform. They’re like a subscription fee – you’re paying to keep your account active. Remember, though, that not every payment processor charges this fee, and those that do often include additional features or benefits to justify the charge. Always weigh the product offering against its cost.

- Then, we have transaction fees. These are incurred every time a customer purchases the payment gateway. These fees are often determined as a percentage of the total transaction amount plus a small fixed charge. So, the revenue generated from sales will be your gross earnings minus these credit card transaction fees.

- Cancellation fees are worth considering, especially if you’re exploring different options and technology stack requirements. This is the fee some processors impose for closing your account before a specified contract period ends.

Now you see, payment processing services aren’t just about the features they offer but also how their charges align with your business model and budget. It’s essential to thoroughly understand these fee structures to continue breaking new sales records without breaking the bank!

Payment Gateway Integration Options

Imagine you’re an online store owner. The last thing you want is a complicated process when integrating a payment gateway. It could potentially disrupt your eCommerce operations and negatively impact customer experience. But don’t worry! Let’s explore your options.

API Integration

If you’re after a seamless customer shopping experience, API (Application Programming Interface) integration might be your ideal solution. It allows customers to complete their transactions while staying on your website. However, while this provides a smooth checkout process, you should know that it does require some technical expertise to implement.

Hosted Payment Gateway

On the other hand, if dealing with the technicalities of API integration sounds like a chore, a hosted payment gateway could be the answer. In this case, customers are redirected to a secure payment page hosted by the payment processing company.

Upon completing their purchase, they’re redirected back to your website. Easy peasy, right? Just keep in mind that while this option is simpler to set up, it may slightly interrupt the browsing experience as users leave your site temporarily to finalize payment.

Direct Post Method

Another approach, often used as a middle ground between API integration and a hosted payment gateway, is the Direct Post method. With this, payment details are still collected on your website’s checkout page.

However, when the customer confirms the purchase, data is sent directly to the payment processor server, not your server. This method reduces your PCI compliance requirements and responsibilities while still delivering a streamlined customer experience.

Every eCommerce business has unique needs—weigh the pros and cons before selecting a payment gateway integration that suits your operations best.

Security and Fraud Prevention Measures

You must understand that the need for implementing strong security and fraud prevention measures cannot be overstated. After all, you’re not just handling your business — you’re handling your customers’ sensitive information, too. Any breach in security could seriously damage your brand image and credibility.

So, what should you be looking for in terms of security? First and foremost, look for a payment processing company that adheres to the Payment Card Industry Data Security Standard (PCI DSS) — this is the industry norm for card payment security. But that’s just the basic requirement!

A secure platform should also offer additional layers of protection, such as secure sockets layer (SSL) encryption, tokenization, and fraud detection algorithms.

SSL encryption is the standard security technology for establishing an encrypted link between a web server and a browser.

This ensures that all data passed between the two remains private and integral. Tokenization, on the other hand, replaces sensitive cardholder information with a unique identifier or ‘token,’ making it much harder for cybercriminals to access sensitive data.

Then, you have fraud detection algorithms, software that help identify unusual activities or patterns that could indicate fraudulent transactions. These systems often use sophisticated machine learning algorithms and real-time analytics to alert businesses to potentially fraudulent activity, thereby protecting your customers and your bottom line.

It’s important to find a payment processing company that doesn’t just offer these features but one that keeps on top of emerging threats and develops its defense mechanisms accordingly. Hence, your payment system remains secure today and in the future.

International Payment Capabilities

If you’re venturing into global markets, you understand that handling international payments is no small task. But you need a payment processing partner that makes the process seamless, no matter where your customers are on the globe.

First off, you’ll want a company that supports multiple currencies. Few things are more frustrating for your overseas customers than attempting to figure out conversion rates and having unexpected charges because the payment processor only supports one currency.

So, a processor with multi-currency support lifts that burden off their shoulders and improves your customer’s shopping experience.

Next, language is also an imperative point. Your customers need to understand every detail of their transactions. So having a service that includes multiple language support means your consumers can comprehend what they’re paying and why, reducing the chance of disputes or refunds and, ultimately, building trust in your brand.

Lastly, you need the payment provider to have a robust worldwide network. This means processing payments anywhere and ensuring transactions go through smoothly, swiftly, and securely.

These companies have established robust networks with foreign banks, enabling quicker transaction times, reliable service, and peace of mind for you and your customers.

All these factors give your business a reliable, efficient, and convenient path to global sales growth. So when choosing an eCommerce payment processing company, consider their international payment capabilities as an essential feature for your business expansion.

Final Thoughts on eCommerce Payment Systems

Choosing the right eCommerce payment processing solution can significantly impact your business’s success. Not only can it streamline credit card transactions, making shopping experiences smoother for your customers, but it can also open up new avenues for your company to cater to shoppers from various countries.

Ensure you choose a solution that fits your business model and supports your expansion plans. After all, a robust payment processing system isn’t just a tool — it’s a strategic business asset.

Co-Founder at Ecommerce CEO and Orbit Local, Board Member at Three Grains of Rice Missions, Darren has an MBA in Internet Marketing and 10+ years of experience marketing retail, manufacturing, and Internet marketing corporations, 7-figure brands and startups online.